290x Filetype DOCX File size 0.03 MB Source: www2.gov.bc.ca

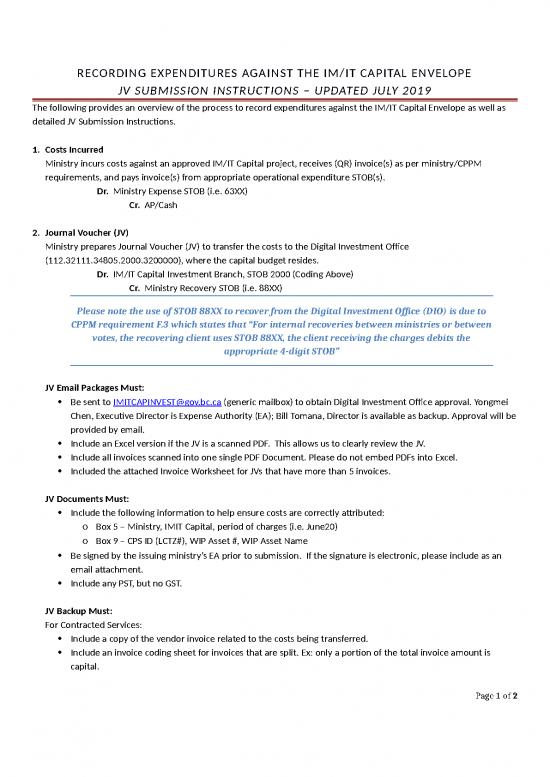

RECORDING EXPENDITURES AGAINST THE IM/IT CAPITAL ENVELOPE

JV SUBMISSION INSTRUCTIONS – UPDATED JULY 2019

The following provides an overview of the process to record expenditures against the IM/IT Capital Envelope as well as

detailed JV Submission Instructions.

1. Costs Incurred

Ministry incurs costs against an approved IM/IT Capital project, receives (QR) invoice(s) as per ministry/CPPM

requirements, and pays invoice(s) from appropriate operational expenditure STOB(s).

Dr. Ministry Expense STOB (i.e. 63XX)

Cr. AP/Cash

2. Journal Voucher (JV)

Ministry prepares Journal Voucher (JV) to transfer the costs to the Digital Investment Office

(112.32111.34805.2000.3200000), where the capital budget resides.

Dr. IM/IT Capital Investment Branch, STOB 2000 (Coding Above)

Cr. Ministry Recovery STOB (i.e. 88XX)

Please note the use of STOB 88XX to recover from the Digital Investment Office (DIO) is due to

CPPM requirement F.3 which states that “For internal recoveries between ministries or between

votes, the recovering client uses STOB 88XX, the client receiving the charges debits the

appropriate 4-digit STOB”

JV Email Packages Must:

Be sent to IMITCAPINVEST@gov.bc.ca (generic mailbox) to obtain Digital Investment Office approval. Yongmei

Chen, Executive Director is Expense Authority (EA); Bill Tomana, Director is available as backup. Approval will be

provided by email.

Include an Excel version if the JV is a scanned PDF. This allows us to clearly review the JV.

Include all invoices scanned into one single PDF Document. Please do not embed PDFs into Excel.

Included the attached Invoice Worksheet for JVs that have more than 5 invoices.

JV Documents Must:

Include the following information to help ensure costs are correctly attributed:

o Box 5 – Ministry, IMIT Capital, period of charges (i.e. June20)

o Box 9 – CPS ID (LCTZ#), WIP Asset #, WIP Asset Name

Be signed by the issuing ministry’s EA prior to submission. If the signature is electronic, please include as an

email attachment.

Include any PST, but no GST.

JV Backup Must:

For Contracted Services:

Include a copy of the vendor invoice related to the costs being transferred.

Include an invoice coding sheet for invoices that are split. Ex: only a portion of the total invoice amount is

capital.

Page 1 of 2

RECORDING EXPENDITURES AGAINST THE IM/IT CAPITAL ENVELOPE

JV SUBMISSION INSTRUCTIONS – UPDATED JULY 2019

Include a GL report showing the invoice costs being paid against the Ministry coding. Please reference the item

on the report.

For Salaries and Benefits:

Include a copy of the timesheets for the period of the costs being transferred.

Include terms of each position. This includes job description and the length of the TA. (Note: the IM/IT Branch

will keep these on file so they do not need to be included with each JV.)

Include a GL report showing the salary and benefits costs being paid against the Ministry coding. Please

reference the item on the report.

If GL report shows an entire paylist versus an individual employee, please include a Peoplesoft report so we can

verify the paylist for that employee matches the GL report

Additional Information:

DIO recommends costs are transferred on a monthly basis.

JVs to clear accruals must be submitted separately from current year items. Invoices must be re-submitted as

they are being JV’d.

JVs to reverse a transfer must be submitted separately from other transfers.

DIO branch can provide ministries with a current list of WIP Asset numbers and names/descriptions if required.

To create a new WIP Asset number, please submit an IM/IT Capital WIP Asset Number Request Form (attached)

to IMITCAPINVEST@gov.bc.ca.

Important Note: the initiating Ministry is responsible for retaining all source documents as per

ministry/CPPM requirements. To reduce the duplicate materials being stored, please do not include

“backup for the backup” unless it is specifically requested (i.e. contractor time sheets and expense

receipts). DIO may request further information later to support requests from central agencies.

3. Asset Requests and Complete/Transfer Assets

When an asset is complete, and all invoices have been applied to the WIP, it gets transferred back to the ministry, who

is responsible for the amortization expense. Ministries will need to send an email to IMITCAPINVEST@gov.bc.ca

requesting an asset report to confirm the amount in the WIP. The Digital Investment Office will send this back to the

ministry along with an IMIT Capital WIP Asset Completion Form to be filled out and submitted. The Digital Investment

Office will confirm once the asset has been transferred. It is the responsibility of the Ministry to capitalize the asset.

Important Note: only one major transaction can occur for each asset in a single period. For example, if

costs were added to a WIP asset in one period, the asset cannot be transferred to Ministry until the

following period.

Page 2 of 2

no reviews yet

Please Login to review.